Understanding Your Options: Military Survivor Benefit Program vs. Indexed Universal Life Insurance for Military Retirees

As military retirees approach their retirement years, they are faced with important decisions that can have a significant impact on their financial well-being. One of these decisions involves choosing between the military Survivor Benefit Plan (SBP) and an Indexed Universal Life (IUL) insurance policy, often referred to as the best IUL option. In this blog post, we will explore the differences between SBP and IUL, and discuss how they can affect retirement planning for military retirees.

Understanding SBP

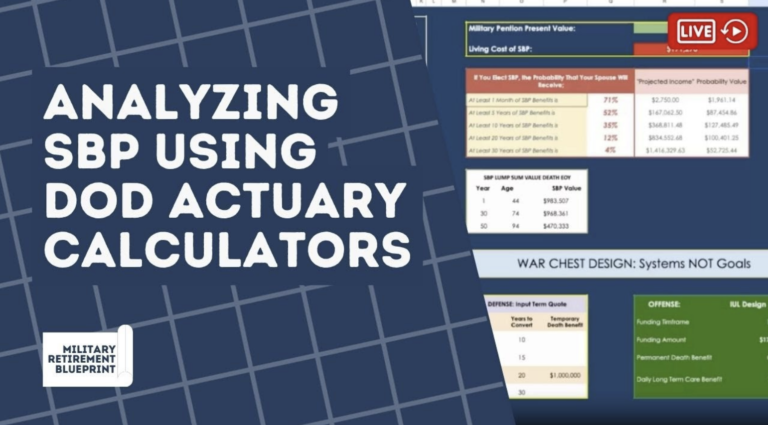

The Survivor Benefit Plan (SBP) is a Department of Defense program that provides a portion of a retiree’s military retirement pay to their eligible survivors after their death. The purpose of the SBP is to provide financial protection to surviving spouses and dependent children. The cost of Survivor Benefit Plan depends on various factors such as the level of coverage chosen and the retiree’s age and health. While the SBP provides a predictable monthly income stream to surviving spouses, it does have some limitations, including SBP costs and SBP coverage issues.

Exploring IUL

On the other hand, an Indexed Universal Life (IUL) insurance policy, often considered the best IUL policy, is a form of permanent life insurance that offers both a death benefit and a cash value component. The cash value portion of an IUL policy, sometimes known as max funded IUL or index whole life insurance, accumulates over time and can be accessed tax-free during the policyholder’s lifetime. The policyholder has the ability to choose how their cash value is invested, with returns based on the performance of a chosen stock market index. This flexibility makes IUL, including best IUL accounts, an attractive option for military retirement and taxes planning.

Comparing the Benefits

When comparing SBP and IUL, it’s important to consider the following factors:

- Cost: SBP premiums are deducted from the retiree’s military retiree pension, while IUL premiums are paid separately. The cost of SBP is based on a percentage of the retiree’s retirement pay and can vary depending on the level of coverage chosen. In contrast, IUL premiums can be adjusted to fit the retiree’s budget and financial goals.

- Flexibility: SBP provides a fixed monthly income to surviving spouses, which can be beneficial for financial planning. However, IUL offers greater flexibility as the policyholder can access the cash value at any time and for any purpose, including supplementing retirement pay from military, funding education expenses, or covering unexpected medical costs.

- Tax Benefits: The death benefit of SBP is subject to federal income tax, while the death benefit from an IUL policy is generally received by beneficiaries income tax-free. Additionally, the cash value of an IUL policy grows tax-deferred and can be accessed tax-free during the policyholder’s lifetime.

- Legacy Planning: One advantage of an IUL policy is the ability to leave a legacy for future generations. Any remaining cash value and death benefit can be passed on to beneficiaries, providing a financial safety net for loved ones, including life insurance for military spouse.

Choosing between SBP and IUL is a critical decision that every military retiree should assess carefully. While SBP offers the security of a guaranteed monthly income to surviving spouses, IUL provides flexibility, tax benefits, and the opportunity for legacy planning. Retirees need to consider their unique financial goals and work with a financial advisor to determine which option aligns best with their 20 years in military retirement plans. By making an informed decision, military retirees can ensure financial security for themselves and their loved ones in the years to come.

Ready to Navigate Your Retirement Options with Confidence? Get a Free Retiree Appraisal! We Help You Make a Confident SBP or TSP Decision. At US VetWealth, we understand the complexities of choosing between the Survivor Benefit Plan (SBP) and the Thrift Savings Plan (TSP). Our expert team is dedicated to helping military retirees like you fully comprehend the financial value of your time in service. Don’t leave your retirement planning to chance. Take advantage of our free appraisal service and make informed decisions for a secure future. Visit https://usvetwealth.com/usvw-appraisal/