The War Chest SBP Alternative

The War Chest SBP Alternative

Redefine Military Retirement Pay

Exclusive Financial Strategies for Elite Military Retirees

Your military career was marked by excellence and precision. Your retirement plan should be no different.

Our War Chest SBP Alternative provides a bespoke strategy tailored for the unique needs of high-income military retirees, offering flexibility, tax advantages, and peace of mind for you and your loved ones.

Why Military Retirees Comes to US VETWEALTH

Challenges with SBP for Military Retirees

Benefit Uncertainty

SBP only pays out if the spouse outlives the retiree, creating uncertainty over the realization of benefits.

High Premium Costs

Compared to private insurance options, SBP can be costly for healthy individuals and requires 30 years of payments.

No Equity Accumulation

SBP does not allow for the accumulation of cash value or equity over time, risking a complete loss of investment.

Limited Beneficiaries

Full SBP coverage does not allow changes in beneficiaries other than surviving spouse, limiting flexibility for retirees.

Lack of Control

Retirees have limited control over the terms and conditions of SBP with no option for generational wealth.

Limited Payout Structure

The payout is limited to the spouse, with no provision for other dependents or beneficiaries.

Impact on Pension

Premiums for SBP are deducted from the military pension, reducing the retiree's monthly income.

Non-Adjustable Coverage

SBP coverage may not adjust adequately to changing life circumstances or inflation.

Removing SBP core Concerns

Why Design a War Chest

Confusion of Military Retirement Entitlements

Breaking down your military retirement pay is not straightforward. The intricate details, from deductions to entitlements, create a perplexing picture that requires careful analysis to ensure you're fully aware of the retirement pay you've earned.

Low Probability of SBP

With the SBP, you're battling against the odds. The chance that your spouse will benefit from the plan is minimal, echoing the uncertainty of a contingency that might never occur, casting doubt on the SBP's role in your comprehensive retirement plan.

SBP Cost vs Benefit Problem

SBP's cost-benefit equation is often imbalanced. The high premiums can erode your retirement earnings with no assurance that the benefits will offset the costs, placing retirees in a position to question the plan's financial prudence for their dependents.

why the war chest sbp alternative works

We Help Guarantee Positive Outcomes

The War Chest SBP Alternative is tailored for those who seek more from their military retirement benefits. It's more than just a death benefit plan; it's a pathway to ensure that your post-service life is financially secure, offering potential to access cash values, tax-free accumulation and income options, and long-term care benefits while living.

Tax-Free Wealth Accumulation

Maximize your financial growth with the War Chest strategy, ensuring your wealth flourishes without the constraints of taxation, fostering a prosperous future.

Cost-Effective and Value-Driven

Opt for an economical yet robust retirement solution. The War Chest approach marries cost-efficiency with high-value benefits, optimizing your financial resources.

Adaptive Coverage Options

Tailor your retirement plan with adaptive coverage options in the War Chest strategy, ensuring your plan evolves with your changing life circumstances.

Future-Proofing Your Finances

Secure your financial future against uncertainty. Our War Chest strategy is designed to safeguard your wealth against unforeseen lifestyle needs and economic changes.

Purposeful Legacy Building

Craft a purposeful legacy with the War Chest approach, ensuring your financial achievements translate into enduring benefits for your heirs and loved ones.

Protected Investment Growth

Enjoy the peace of mind that comes with protected investment profits. The War Chest plan offers a safeguarded path to increasing your wealth with stepped-up annual growth lock-ins.

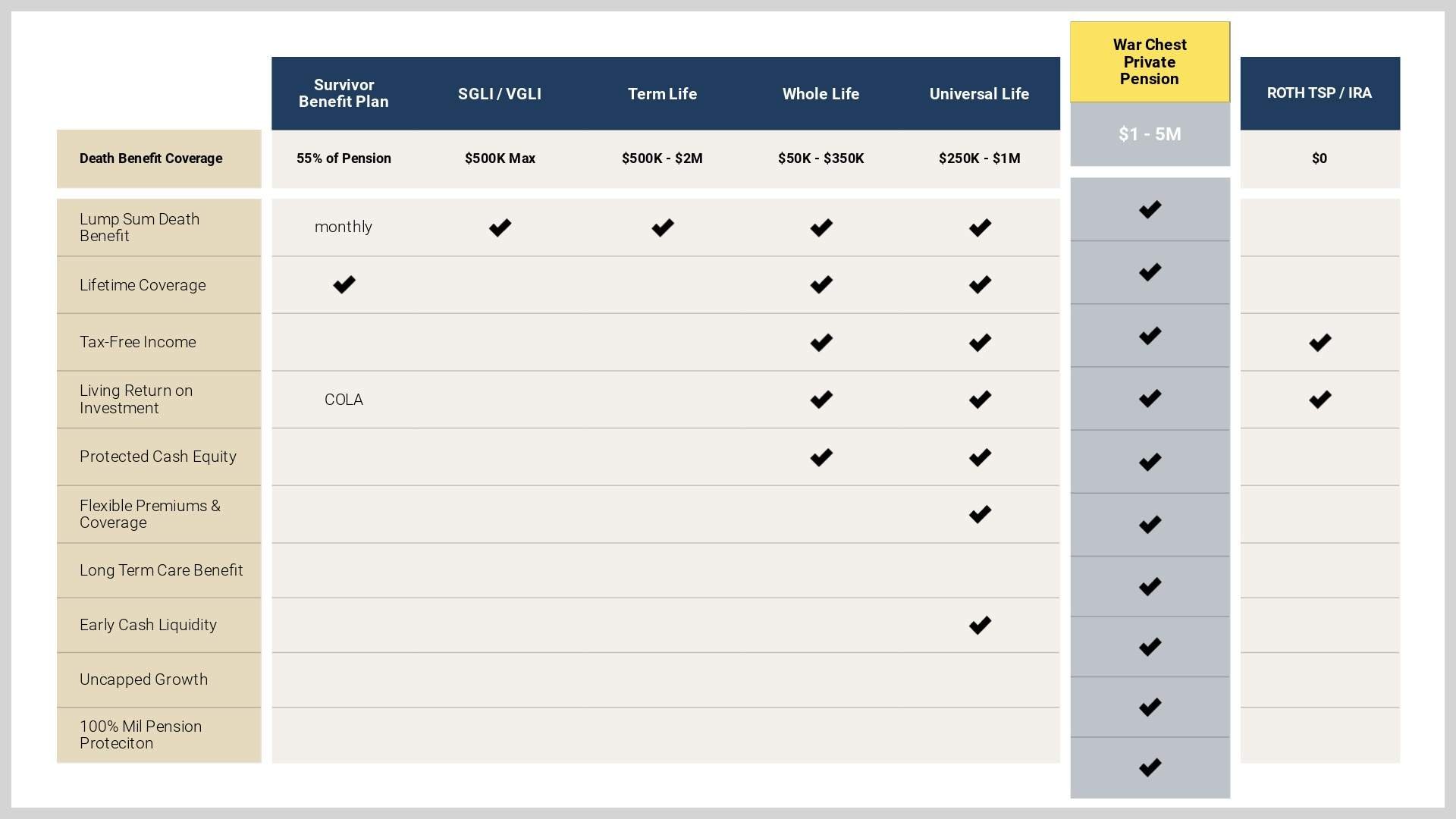

The Better Way to Protection Your Military Pension

How We design Your War Chest

Your War Chest is an Offensive and Defensive Strategy

Strategically designed, your War Chest safeguards assets while aggressively growing your financial frontline for robust protection and growth.

(Click to View Larger Image)

(Click to View Larger Image)

How to Fund and Grow Your War Chest

Fund your War Chest through strategic allocation; watch it expand with smart investments, tailored to your financial landscape.

How to Use Your War Chest

Leverage your War Chest for life's milestones, ensuring it serves your family's needs with flexibility and strength.

(Click to View Larger Image)

01.

Read The War Chest Book

Lay the Groundwork with Essential Knowledge: 'Don't Forget Your War Chest' is more than a book; it's your preliminary guide to understanding the nuances of high-income planning in post-military life. Start here to grasp the key concepts that will be expanded upon in the course.

02.

Watch SBP Decision Course

Expand Your Retirement Planning Horizons: The SBP Decision Course builds upon the foundational knowledge from the book. Engage with each lesson to navigate the specifics of SBP and related financial decisions with confidence.

03.

Schedule Free Consultation

Personalize Your Financial Strategy: Completing the course equips you with knowledge, but every situation is unique. Schedule a free consultation to tailor what you’ve learned to your specific circumstances, ensuring your retirement plan is as robust as it can be.

how to learn more about the war chest sbp alternative

Get a Free Copy of the Book and Bonus Videos

Learn at Your Own Pace

Join our free Military Retirement Blueprint members portal where we share dozens of additional articles, videos and host senior leader civilian networking training. All free, you've got nothing to lose!

Here’s what people are saying about the course

“

Having a War Chest made my SBP decision easier

As a long time client of Scott's I've been systematically building my War Chest and never had to worry about market fluctuations or future insurance needs. I loved that I am able to accomplish all my post-military objectives with one strategy that protects my pension and my savings.

Kathryn Maitrejean

LtCol(R) USAF

“

Scott Tucker is a trusted credible and relevant resource

When I retired from the Navy after 30 years, I was shocked at the high cost and limited benefit of SBP. I didn't have anyone to turn to for actionable advice on this critical decision. Now, retirees like me no longer have to stress about this decision as Scott's book will help you make a competent and confident decision with ease.