1035 Exchange: Avoid Taxes On A Surrender Life Insurance Policy For Cash Value

One of the biggest mistake Veterans make with their old whole life insurance policies is not realizing that it's possible that a cash surrender value is taxable. This is completely avoidable because you don't have to surrender a cash value life insurance policy to get access to your money. In fact, there's a good reason not to surrender life insurance policy for cash value because of a little known provision in the IRS code called a 1035 exchange.

What is a 1035 Exchange?

A 1035 Exchange takes place when a client with a Whole Life Insurance policy uses the cash value inside this policy to create a new permanent Life Insurance policy with better cash value growth and access and more protections.

Whole Life policies have been on the market since the 19th century and have long been used as a source of dependable, uncorrelated dollars. For all these years, the drawback to having whole life insurance was lackadaisical pace at which whole life insurance cash value grows.

That no longer has to be the case.

Permanent Life Insurance Upgrade

An Index Universal Life policy cash value is configured to mimic the performance of an S&P Index, in our case, the S&P 500. As is the case with Traditional Whole Life, the premiums paid in are treated as principle and guaranteed not to lose value. As such, when the S&P 500 experiences a drop, the cash value in an Index Universal Life policy does not drop at all. Since there is a floor, there must be a ceiling. That ceiling is typically less than 10%.

Returns guaranteed not to drop, reaching up to 12%, compounded annually are incredibly attractive.

Thanks to 1035 exchanges, policyholders who bought traditional whole life before they knew about IULs can join the party. Once the IUL carrier medically underwrites these clients, they can use the cash value in their traditional whole life policies as single premiums for brand new IUL’s so that they can experience those same returns.

On the securities market, if a client is unsatisfied with the returns his/her wealth management advisor has been attaining, the client is free to withdraw his/her assets and place them under management elsewhere. Of course, when this happens, the new wire house is going to charge this person new management fees.

When a person performs a 1035 exchange, there are no fees. The entirety of that person’s cash value becomes principle in a new policy cash value. Now the cash value can participate in the growth of the market.

If this client chooses, this client never has to make another contribution to the policy again.

Scenario:

E8 is on the verge of retirement. He has had a Whole Life Policy with another Military Financial Company. Policy has been providing a dividend of 4-5% like clockwork. Policy was obtained 20 years ago for $100,000.00. Policy has a Cash Value of $30,000.00.

The E8 must be medically underwritten again, but if he qualifies, that $60,000.00 cash value can provide a larger death benefit, greater cash value growth, and he will never have to make another contribution again unless he wants to.

Why to Consider Using a 1035 Exchange?

If you surrender life insurance policy for cash value you risk losing paid up death benefit and may have to pay taxes. But you can avoid that. A 1035 exchange is a provision in the Internal Revenue Service (IRS) code that permits individuals to transfer an existing annuity contract, life insurance policy, long-term care product, or endowment for another one of like kind, tax free. 1035 exchanges are often confused with 1031 exchanges, which deal with a real estate owner selling one piece of property and using the proceeds to help with the purchase of another piece of property.

Since the liquidity associated with a piece of real estate is being transferred into another piece of real estate, the funds generated from the sale of the first property are considered immune from income taxes or capital gains taxes. A 1031 exchange is considered an exchange of like properties. A 1035 exchange works in a similar way for life insurance policies.

Under IRS Code 1035, a policy owner is allowed to cash out an existing life insurance policy and use the cash value as the premium or part of the premium for a new life insurance policy. Although the aforementioned policy owner is completely liquidating his or her life insurance policy, which would ordinarily result in a taxable event, because the liquidated funds are being immediately moved into another life insurance policy, they are not taxable as income or as capital gains.

For a 1035 exchange to work, both the owner and the insured must be identical on both policies. The funds also must be transferred DIRECTLY from the old carrier to the new carrier. Transferring the cash value of the policy into the insured’s bank account before moving it into the new policy may trigger a tax requirement.

There are many reasons a policyholder may want to exchange one policy for another. The needs, plans, and cash flow of any insured all change over time. The life insurance industry also responds to changes in demand and changes in the overall economy. Many industry changes result in newer and enhanced benefits for holders of newer policies that were not available when some older policies were initially written. Some of these benefits include enhanced cash value growth.

A whole life insurance policy is written to protect the insured’s principle at the expense of growth opportunity. An indexed life insurance policy, on the other hand, can offer similar principle protection while also allowing that principle to grow. For this reason, it can make sense for a person to use the cash value in a whole life insurance policy to fund an indexed life insurance policy in order to grow their principle. Such an exchange is an opportunity to give the money that you have “working for you” a “raise.”

Another reason to consider a 1035 exchange is if the existing life insurance policy doesn’t offer a long-term care rider. Traditional long-term care insurance has gotten progressively more expensive, and still offers no equity or benefit in the event that long-term care is not needed. A very popular solution is to include a long-term care rider on a life insurance policy. In this case, a policy could pay out as a reimbursement or indemnity up to the full amount of the death benefit to cover the cost of long-term care for the insured.

Just because a policy was the best option available for you when you signed up for it does NOT mean you are stuck with it. Military financial planning is a continuous process, not a singular event. If you do not periodically review your financial situation, you are doing yourself a great disservice. A financial advisor who behaves as though his relationship with a client is finished once the client buys whatever product or service the advisor is selling should quit the industry: he or she is performing a horrific disservice to both their clients and the industry at large.

If you don’t remember the last time your financial advisor reached out to you, or what you set up with them, you definitely owe it to yourself to reach out to us here at US VetWealth.

Work With Us

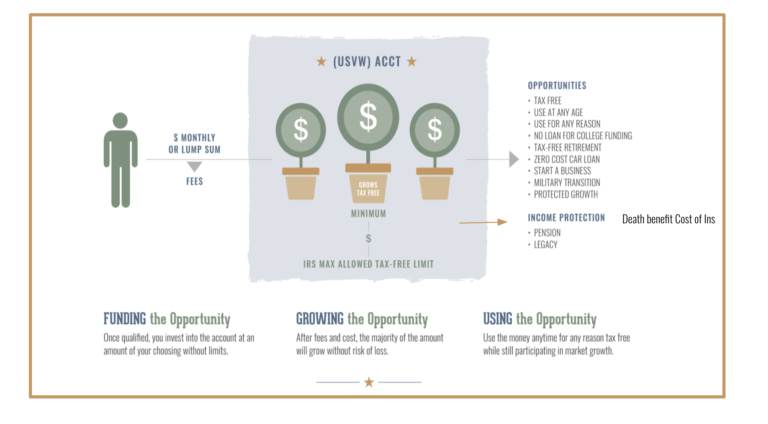

A client with a traditional whole life policy can use a 1035 exchange to deploy the cash value in that traditional whole life policy as a premium for a brand new IUL and thus inject some steroids into his dependable tax free cash value.

The ONLY requirement is that the insured must be underwritten in order to qualify for the new Indexed Universal Life for which he/she must be approved in order to make the exchange.

If you have a traditional whole life and want to use that cash value to participate in market growth, contact us today to schedule a discovery call to see if a 1035 exchange to an IUL is right for you.