The Best New Life Insurance for Veterans

What is the best life insurance for veterans?

The best life insurance for veterans depends entirely on the individual! That is the mistake the majority of service member make when they elect the government sponsored plans such as SGLI, VGLI and SBP. They aren't being rewarded for their personal health and financial potential. Instead, everyone is treated the same and risks a tremendous amount of lost opportunity cost. The best Life Insurance for Military veterans is whatever the individual can qualify for on the private market!

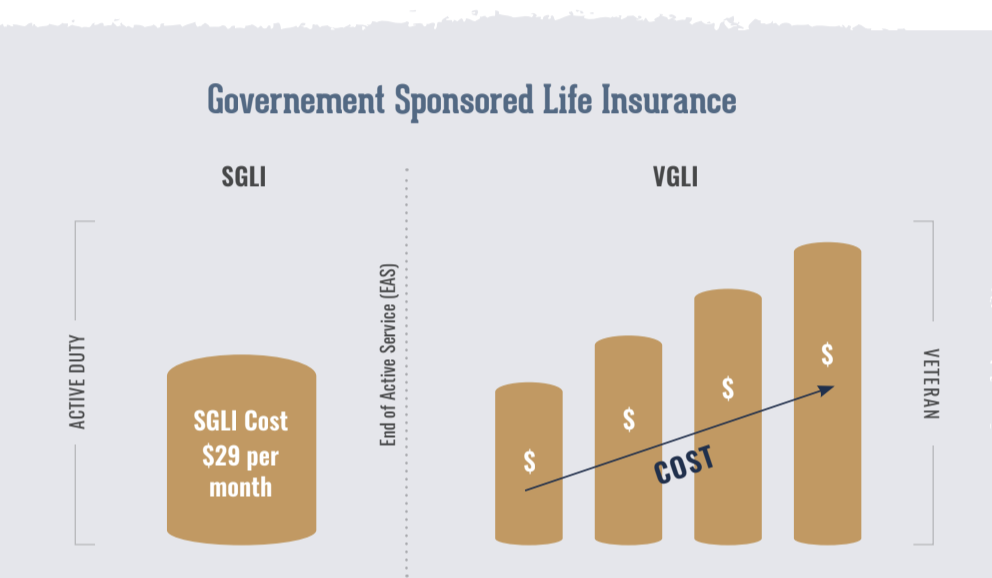

Does VA offer life insurance for veterans?

Yes, the Veterans Administration offers Veterans Group Life Insurance (VGLI) to all those leaving regular military service. The important thing to note is that if you transfer within the 240 day window, you don't have to be underwritten. The problem however, is that regardless of how healthy you are you pay the same price as everyone. This is inefficient if you could qualify for the same amount on the private marketplace.

Do retired military have free life insurance?

No, life insurance is not automatically included for military retirees. They have the option to participate in the Survivor Benefit Plan (SBP_ to protect 55% of the pension should they pre-decease their spouse. However, that comes at a cost of 6.5% of the pension annually for a maximum of 30 years! For the average military officer retiree that would be around $150,000 of committed SBP payments.

Life Insurance for Veterans is A Rapidly Evolving Industry

In the noble profession of financial advice, insurance sales, and financial planning, there are as many theories about the ideal financial planning tool as there are dollars to be made. There are nuances to every product, and there are many different solutions that may work to meet a client’s needs. As time passes, interest rates change, life expectancy increases, and solutions evolve. Financial advisers must remain abreast of these changes and keep their clients similarly informed.

Far too often, financial advisory companies emphasize the client acquisition process at the expense of the client servicing process. The idea of “one and done” is used as financial advisers, forever chasing their next commission check, keep filling their calendars with new consultation appointments, and often neglect the clients who occupy their current book of business — and for good reason. Yesterday’s deals do not pay today’s bills.

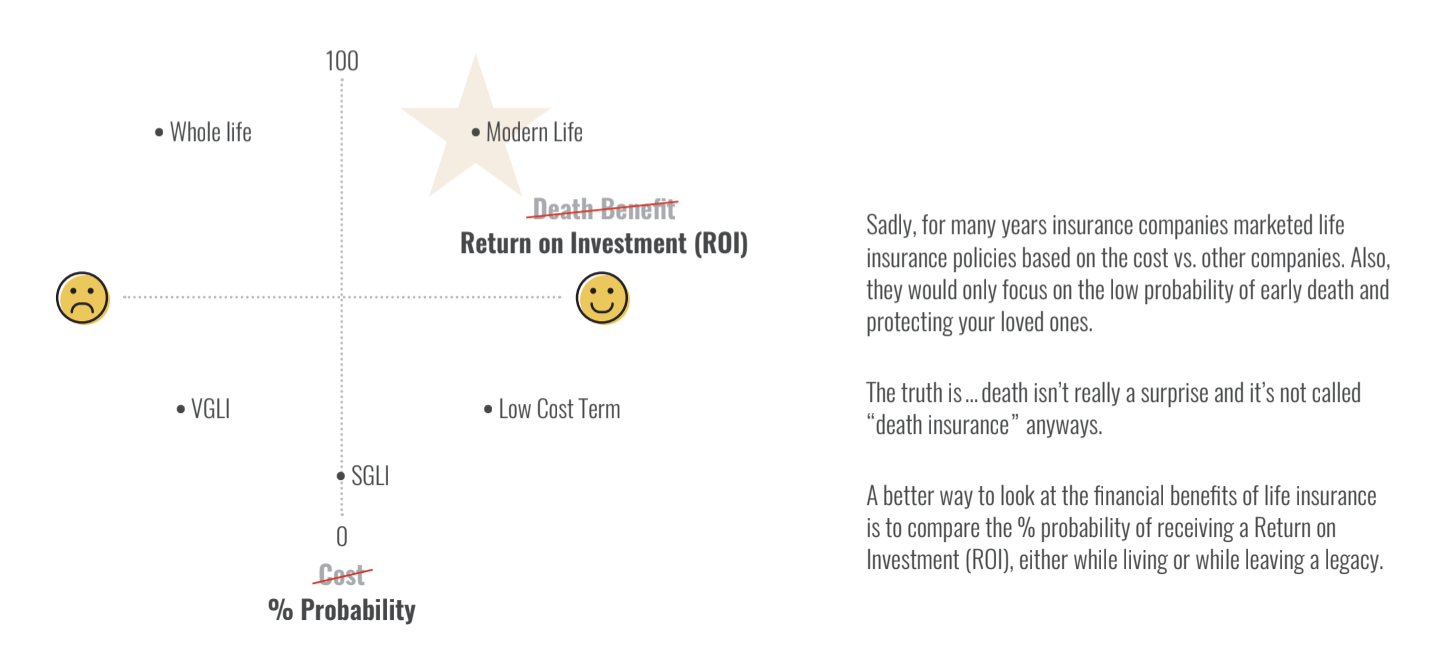

Within this ruthless market, there are those who argue that a client would be better served by buying a term life insurance policy and putting the rest of his or her disposable income in the securities market. Why spend thousands of dollars a month on a policy that lasts forever if you may not need all those death benefits past a certain age? Just get a policy with an expiration date. Put the rest into a managed account. The stock market has greater accumulation potential than an insurance policy.

Cheap Life Insurance for Veterans Actually Costs More

This school of thought speaks to a person’s tendency towards frugality. It also caters to financial services companies that make most of their money through the accumulation of assets under management. They make their annual 1.49% management fee and their “active managers” are off to pursue additional clients to increase their firms’ assets under management (AUM). On the surface, this school of thought seems sensible. A person’s family is covered in the event of a loss of life, and their assets are accumulating tax-deferred growth in the securities market in order to provide a comfortable retirement nest egg.

There are a few issues with this particular school of thought. Namely, the term “invest the rest” is rather vague. There are many investment objectives. There are nine different asset classes in the securities market that all have symbiotic, but often inverse, relationships with one another. These include equities such as U.S. Large Cap stocks, U.S. Mid Cap Stocks, U.S. Low Cap Stocks, International Developed Stocks, International Emerging Stocks, Real Estate, Bonds, and Cash. Every single one of these asset classes falls under the legal definition of security.

A “security” is an investment asset in which some or all of the principle is placed at risk of loss.

A Modern Safe Approach to Veterans Life Insurance

There is another school of thought that emphasizes the tax efficiencies of cash value from permanent life insurance. Term insurance policies are very inexpensive because 98% of term life insurance policyholders either outlive their policies or cancel them. With only a 2% probability of paying out, these policies are easy money for insurance carriers. Permanent life insurance offers tax-deferred growth and tax-free distributions of cash value growth. Though they offer lower rates of returns than the securities market, particularly the stock market, they do not offer risks of loss due to market volatility. As a result, a well-planned, well-funded permanent life insurance policy can be an excellent source of safe dollars.

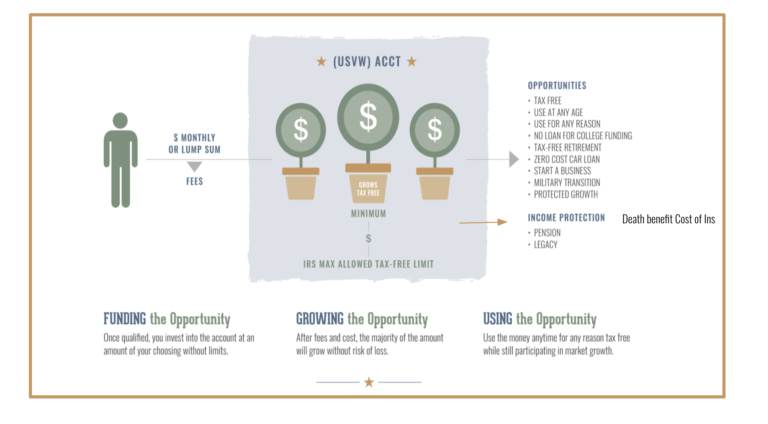

Into the fray comes the Modern Veterans Life Insurance policies. This is a form of permanent life insurance that allows a client a great deal more freedom when it comes to funding their policy. But with greater flexibility comes greater responsibility. In a permanent life insurance policy, premiums that are paid in fill two buckets. The first bucket is the cost of insurance (COI).

The cost of insurance is determined based on the company’s morbidity table, where it determines the probability of a person of a given age passing away. It is the amount of funds that must be kept aside in order to pay out every insured at a given age in case of his/her death. The older and less healthy a person is, the greater amount the COI is. As a person ages, it costs more to insure him/her. Permanent life insurance solves this problem by being priced out to fill this bucket within the first 5-10 years that the policy is in force. As this bucket is filled up, the excess is paid into a second bucket, cash value. This cash value is liquid, not subject to income taxation, and grows outside of the market.

Universal Life Insurance allows a client to choose how quickly the funds in his or her policy accumulate value by setting his or her own contribution schedule and adjusting it as he or she wishes to. It is thus incumbent on the client’s financial adviser to maintain a long-term relationship with the client, keeping the client aware of the rates of return and the company’s overall expense ratio.

Modern Life Insurance For Veterans

The History No One Tells You

In the 1980s and early 1990s, both schools of thought for financial services operated like the Wild West. It was the era of Jordan Belfort and Barry Minkow and the San Marino Savings and Loan Scandal. On the Life Insurance side, the manner in which Universal Life Insurance was peddled in that era could well be compared to the manner in which a Stratton Oakmont day-trader hooked a new client. While we could argue about the accuracy in which Martin Scorsese’s Wolf of Wall Street portrayed Belfort, the manner in which Stratton traders conducted business was quite accurate. With dollar signs behind their eyes and an eye towards collecting another fat sales commission, these young men would extol the virtues of this stock and that one, advising their clients to invest all they could.

Now, although the senior-level Stratton Oakmont Traders were fully aware of the illegality of their actions, they recruited sales teams composed of less than the best and the brightest. Often, many of these floor-level traders had little understanding of the illegality or even the immorality of their activities. This double-blind robbery could leave many unsuspecting clients fleeced out of their money, yet none the wiser as to what had happened to it.

In the sales of Universal Life Insurance, a similar type of double-blind swindling was taking place. When life insurance sales agents got in front of their clients, they showed their clients illustrations with grossly exaggerated rates of return. These rates of return were illustrated at 11% compounded annually. This definitely sounds awesome, almost too awesome to be true. In the 1980s and the early 1990s, interest rates were very high. Yet, in all investments, past performance does not guarantee future behavior. In high-interest-rate environments, many agents representing well known companies sold Universal Life Insurance policies with such illustrations.

Buried in the fine print, however, is the insurance company’s investment spread. Essentially, these spreads are the difference between “earned” rates from assets versus “paid/credited” rates to insurance contracts. This disparity and the right of a company to adjust it would have serious ramifications regarding the disparity between illustrated rates of return and actual rates of return.

Many of these companies offered lower spread during periods of high interest rates with the right to readjust the spread during periods of high interest rates. Keep in mind that when a life insurance company collects premiums from its policy holders, these premiums are placed in the company’s overall investment portfolio, which is composed primarily of high-end real estate and high-yield corporate bonds.

The returns obtained from these investments are relatively stable, but also correlated with interest rates. To mitigate against this, insurance companies can keep their operating expenses low. This keeps the spread from fluctuating wildly. Unfortunately, the aforementioned companies failed to do this, causing their spreads to expand wildly when interest rates dropped. Add this to the fact that the illustrated rates of returns were exorbitant.

Further add the fact that these illustrated high rates of return caused many agents to recommend that their clients under-fund their universal life insurance policy, and you have a situation in which many universal life insurance policyholders who have paid into their policies for 15-20 years request an in-force ledger only to find that their policies are devoid of cash value and are in danger of lapsing.

Military and Veteran Life Insurance Guidance You Can Trust

This is a tragic situation akin to one faced by victims of Ponzi schemes. It is made all the more tragic by virtue of the fact that less than one insurance sales agent in a hundred even knows what an investment spread is. We had a rash of people who were swindled by sales agents who did not even realize that they were swindling their clients.

When reading these stories, no one is saying to paint all investment advisers or Registered Investment Advisers with the same brush as the Belforts, the Minkows, the Madoffs, and the Ponzis. In this same vein, it would be equally foolish to paint all companies that offer permanent life insurance solutions, particularly the more modernized Life Insurance solutions with the same brush as those who perpetrated the aforementioned bad faith sales.

Yet, in a marketing email sent to a prospective sales agent one company attempted to use the settlement to a class action lawsuit against Transamerica to point out the “dark side of universal life insurance,” as if all universal life insurance transactions would lead to the same bleak outcome as that which befell the plaintiffs of this class action lawsuit.

This underhanded oversimplification is a tool to incentivize people to place more of their investment assets into securities. This can be a decent accumulation strategy. Of course, the securities market is fraught with volatility. With volatility comes the opportunity for growth. However, investing exclusively in this arena leaves many people subject to the double sequence of returns risk and income taxation risk, which leaves many people who work hard and save well penniless in their old age.

This is especially important because investment firms and financial wirehouses can wax poetic about their accumulation capabilities and rates of return that their assets under management achieve, but they offer ZERO advice on how to DISTRIBUTE assets under their management. Why would they? Every dime taken out of their clients’ investment accounts is one less dime under their management and cuts into their 1.5% annual management fee. Yet, what good is an account balance if a person cannot spend it?

Fixed products in the insurance market can be a great way to mitigate against the risks of income taxation and market volatility and have many built-in ways to prevent a client’s account balance from reaching zero, while providing a client with a tax-efficient, principle-protected liquidity.

It would be the height of hypocrisy to advocate the use of fixed products to the total exclusion of securities products. However, the nature of the relationship between investors and their advisers must change. These relationships must be cultivated the way a family cultivates a relationship with its family doctor. The family must trust the doctor’s integrity. The doctor must be willing to make himself a trusted adviser to the family. The doctor must abide by his Hippocratic oath to first do no harm. The family must keep in regular contact with the doctor, so that the doctor can respond in kind to the family’s changing needs. The doctor must keep up with the latest medical trends in order to provide his patients with the most up-to-date advice. Such relationships lend themselves poorly to the rapid transactional practices of financial advisory firms and insurance companies.

It is in this vein that financial experts must determine the interests of their clients and accordingly recommend a uniquely tailored blend of insurance and securities-based instruments. As the clients’ situation evolves, so must this blend evolve. That recommendation may involve term insurance, it may involve permanent life insurance for veterans, it may involve large stock positions, or bond positions. There is no panacea, nor is the same advice necessarily applicable to any two situations, except for this: Do your homework. Do not pass judgment on an entire asset class based on one story. And above all, make sure that you evaluate your situation with a knowledgeable expert that you can trust.

Get a Military Veteran Life Insurance Policy Review [FREE]

Are you confused about VGLI and SBP. Or maybe you have an old Term or Whole Life Insurance policy. Schedule a FREE consultation to see if qualify to upgrade to a modern approach.