Life Insurance and Annuity Strategies for The High-Income Military Retiree

Life Insurance and Annuity Strategies for The High-Income Military Retiree

We help you capitalize on your above-average health and substantial income-earning potential for post-military life.

see how easy it is to

Guarantee Your Lifetime Income with The War Chest Strategy™️

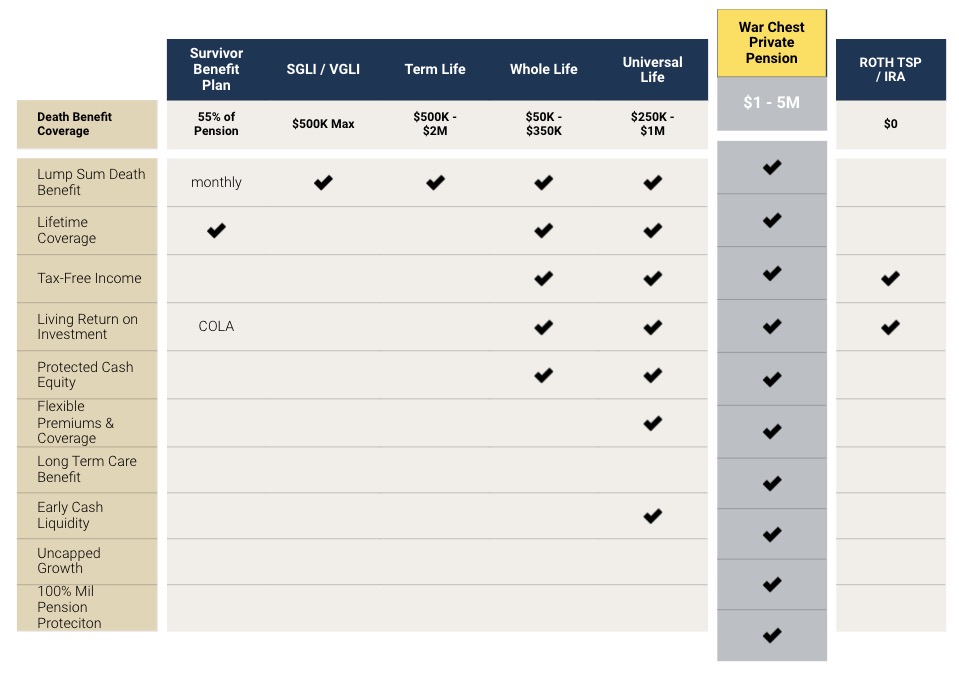

Bypass Costly SBP Premiums

Escape SBP's rigid structure that consumes 6.5% of your pension that can accumulate to immense sums without the possibility of allocating benefits to adult children

Health-Based Pension Maximization

Capitalize on your good-health today to ensure complete pension preservation, far exceeding SBP's meager 55% benefit, with legacy transfer capabilities

Outperform COLA, Risk-Free

Surpass standard COLA inflation adjustments safely; enjoy superior returns without the worry of market downturns

Assure TSP Principal Preservation

Guarantee your Thrift Savings Plan (TSP) principal preservation while establishing a lifelong private pension, ensuring financial security you can't outlive

WHO WE ARE:

US VetWealth stands as the premier wealth insurance consultancy dedicated exclusively to serving retired Military Officers and NCOs. We cater to those who, in their post-military careers, are achieving or aiming for an annual gross income of $250K+. Our expertise is in guiding high-achieving leaders who have demonstrated exceptional performance both in their military service and in their transition to civilian life.

US VetWealth stands as the premier wealth insurance consultancy dedicated exclusively to serving retired Military Officers and NCOs. We cater to those who, in their post-military careers, are achieving or aiming for an annual gross income of $250K+. Our expertise is in guiding high-achieving leaders who have demonstrated exceptional performance both in their military service and in their transition to civilian life.

featured by

featured by

What we do

We Help Military Retirees Make Informed Decisions About SBP, TSP, VGLI, & more!

What we do

We Help Military Retirees Make Informed Decisions About SBP, TSP, VGLI, & more!

The War Chest Strategy™: Your Path to Income Independence, sooner

We designed the War Chest Strategy™️™exclusively for you because we discovered that traditional financial planning was not serving your needs when it came to answering questions about what to do about your military retirement pay & benefits such as SBP, TSP and VGLI.

One significant flaw of the standard SBP is the inability to change beneficiaries, posing the risk of losing all contributions if the spouse dies first. Our solution revolutionizes this approach. We guarantee a return on investment in any eventuality, providing financial certainty and flexibility.

The War Chest Strategy™️ is more than just a backup plan; it's a resource for you to tap into during your retirement, whether for leisure, investment, or other personal milestones.

With US VetWealth's War Chest Strategy™, your TSP balance transforms into a fortified private pension. Our approach ensures the principal is shielded from market losses and matures into a guaranteed income source in just ten years.

Choosing to transition from TSP to a Private Pension is not just a smart move for military retirees; it's a strategic step towards securing a financially robust and worry-free retirement.

Attaining a high-income or high net worth status often ushers in unexpected financial complexities, particularly in asset distribution. Our wealth insurance consulting services are designed for those in this echelon, moving beyond the accumulation phase to master the art of wealth distribution.

We guide you in transitioning smoothly to this crucial stage, ensuring your financial success is preserved and prudently managed."

Key Benefits

Rewards for good health

Capitalizing on your well-being, we offer unique rewards for your above average health. It's more than just living healthy; it's about reaping the financial benefits that come with it.

Guaranteed Income

Enjoy the stability of guaranteed income. Our wealth insurance strategies are designed to ensure you have a consistent and reliable source of funds in your retirement.

Safe money investing

Invest with confidence in safe money strategies. We focus on insuring secure investment options that protect your capital while offering steady growth.

Grow your net worth

Elevate your financial status by growing your net worth without risk of losing principle. Our bespoke financial strategies are designed to amplify your assets and wealth.

Increase your knowledge

Transition from basic financial education to high-level financial decision-making. As your income grows, so should your financial insights. We provide you with the missing resources.

see what others have to say

You're in good company

❝

US VetWealth stands out as a current, relevant, and credible resource, offering a unique alternative to ETAP's broad advice, specializing in personalized financial strategies for SBP and TSP. Their approach ensures military retirees receive tailored guidance, aligning their retirement plans with individual financial objectives for a secure and well-planned future.

Mike Wallace - USN CAPT(R) // Founder of Blue Water Advisors

The key to financial peace of mind is education and finding advisors who have your best interests at heart. Scott and Jen represent that trust and professionalism to me. I'm fully assured that they handle my financial matters with integrity and expertise. It's truly a privilege to have advisors like them in your corner.

Stephanie Brown - Spouse of RADM(R) // Founder of The Rosie Network

US VetWealth is a gold mine for military retirees! His IUL and FIA products are two game changers that I added to my portfolio to help my family solve life insurance, long term care, risk mitigation, distribution strategy, tax problems, and more. Scott encouraged me to proceed at my own pace, do my own independent research, and bring my personal financial advisor into all the conversations so that everything was transparent!

Matt Anderson - Colonel, USAF (Retired)

our process

Building Your War Chest: A Tactical Five-Step Process

Your Benefits, Optimized

Step 1: Education On The Problem-Solution Set

Our first step is to arm you with knowledge, clarifying the financial hurdles ahead and mapping out the solutions tailored for your transition.

Step 2: Military Pay & Benefits Appraisal

We then collaborate on a detailed evaluation of your military pay and benefits, identifying opportunities for maximization.

Step 3: Presenting A Wealth Insurance Strategy

Following the appraisal, we outline a wealth insurance strategy that secures and elevates your assets for long-term stability.

Step 4: Application to Qualify

At this phase, you apply to qualify, ensuring that our wealth insurance solutions align perfectly with your financial profile.

Step 5: We Implement A Personalized Offer

Finally, upon approval, we put your personalized offer into action, meticulously implementing the strategies that will bring your financial goals to fruition.

Redefining Retirement: Seize Your Military Advantage

Don't fall into the trap of planning for the wrong retirement!

Traditional retirement planning often fixates on a distant future, routinely missing the distinct financial realities of career service members.

Our War Chest strategy recognizes the exceptional opportunities military retirees possess—opportunities that standard American retirement plans fail to acknowledge. We shift the focus, ensuring you maximize your pension benefits promptly, not years down the line.

It's about more than the American Dream deferred; it's about fully embracing the retirement you've honorably earned, starting now.

Customers served!

0 yrsUSVW Combined Experience

Customers served!

0 +FREE Articles & Videos Available

Customers served!

$ 0 MValue of Military Pensions Protected

Customers served!

$ 0 MClient SBP Costs Avoided

You served for it. You earned it.

(FAQs) Frequently Asked Questions

At US VetWealth, the War Chest Strategy represents a paradigm shift from conventional financial planning goals to a more robust, system-based approach. This strategy is particularly suited to the modern economy's unpredictability and is tailored to the unique benefits you've earned as a military retiree. Our focus is on secure money strategies involving life insurance and annuity policies, entering you into contracts with major US insurers that traditionally serve high-net-worth individuals. This approach is grounded in your proven income-generating abilities, not on the speculative nature of stock market investments.

The War Chest Strategy comprehensively addresses the most critical risks affecting your retirement savings: market volatility, taxation, excessive fees, income distribution, and advisory uncertainties. By insuring both your assets and income, this strategy liberates you from financial worries, enabling you to concentrate on what truly impacts your life – be it a new career path, entrepreneurial ventures, quality family time, or a peaceful and fulfilling retirement.

Discovering if you qualify for an SBP alternative is simpler than you might think. The Survivor Benefit Plan (SBP) is a one-size-fits-all solution, charging a uniform 6.5% rate for all military retirees, regardless of health. However, if you're in good health, you might be paying more than necessary. We offer a streamlined underwriting process to assess if you qualify for a private life insurance solution, which could lead to more favorable rates and enhanced financial security during your retirement years.

It's not just about qualification; it's about finding a solution that aligns perfectly with your health status and financial goals. Let's explore your options together for a more tailored and cost-effective retirement plan.

Converting your TSP into a guaranteed lifetime income requires a strategic approach. While the TSP annuity option might seem straightforward, it limits your financial flexibility by using your TSP principal solely for a COLA based fixed income stream and offers no legacy potential for your loved ones.

At US VetWealth, we recommend a more innovative and secure route: privatized annuities. This approach not only maintains your access to the principal but also ensures asset growth during your retirement years. Our strategy guarantees a lifetime income, safeguarded against market fluctuations and inflation, and dynamically adjusts to enhance your financial stability year after year. Plus, it includes a death benefit, ensuring that your family is protected financially, should you meet an untimely demise. It’s a comprehensive solution that respects both your present and future financial needs.

No. At US VetWealth, we recognize the unique financial journey of military retirees and have thus crafted an innovative approach that differs significantly from traditional financial planning. Our method is not a 'done for you' service where we take control of your assets and dictate your financial moves.

Instead, we believe in a partnership model – a 'done with you' approach. We view our role as that of a consultant, working alongside you and any existing financial advisors you may have. Our aim is to enhance and diversify your financial strategy, not to replace what you already have in place. By partnering with a wide array of life insurance carriers, we offer you the best insurance and annuity solutions without the extra fees typically associated with traditional financial planning. This approach ensures that more of your hard-earned money is invested in your future, right from the start.

Therefore, we proudly offer a complimentary strategy consultation tailored specifically for military retirees and active service members. We understand the unique challenges and questions you may face. This free consultation is designed to swiftly provide answers to your most urgent inquiries, ensuring you can confidently decide if our services align with your needs. It's an opportunity to address key concerns, allowing you to focus on other critical aspects of your life, like transitioning to a new career or navigating VA disability claims.

Ready to take the first step? Click here to schedule your free consultation and embark on a path to clarity and peace of mind.

Yes, at US VetWealth, our services extend beyond the realm of traditional asset accumulation. We understand that certain situations call for advanced programs, including sophisticated estate planning solutions. Tailored to your unique needs, we collaborate with estate planners, lawyers, and CPAs to ensure a holistic approach to your financial future. While extra fees for these specialized services are highly unlikely, they may apply in certain complex scenarios.

Additionally, we offer a cutting-edge robo-advisor service through Betterment, providing you with a comprehensive financial dashboard. This platform allows you to manage your traditional savings and investments actively, with the flexibility to choose your portfolios. If you seek personalized guidance, our team is ready to assist. Though there is an asset management fee, as with any market-linked solution, we prioritize transparency and informed decision-making, ensuring you understand the market risks involved.

For those desiring an even more hands-on approach, we also offer financial coaching and consulting on a case-by-case basis. Schedule a call to learn more.

Join Our Members Area:

At US VetWealth, we're committed to providing you with comprehensive resources and guidance. We invite you to join our Military Retirement Blueprint portal, a treasure trove of knowledge, absolutely free. Here, you can download insightful books such as "Don't Forget Your War Chest" on the Survivor Benefit Plan and "The TSP to FIA Rollover Blueprint" for post-military retirement. But that's just the start! As a member, you'll gain access to our monthly office hours, workshops, and continually evolving programs. Join a community of over 500 military retirees who are already maximizing these resources.

Your transition into military retirement brings a profound financial revelation, as we've seen in our 15 years of guiding military retirees at US VetWealth. The moment you start receiving your military pension and witnessing your savings grow, you'll realize a crucial fact: you are now among the top 10% of U.S. income earners.

This isn't just a statistic—it's a game-changer for your wealth management strategy. Traditional financial planning, primarily designed for those on a fixed income, doesn't align with your new reality. As a military retiree, especially in your 40s or 50s, you have a unique advantage. You have the opportunity to further develop your capabilities, grow your professional connections, and pursue additional income avenues, all on top of the pension you've earned. This phase of life calls for a dynamic, forward-thinking approach to financial planning, one that leverages your distinguished career and paves the way for continued financial growth and security.

Average annual salary of high-income earners in the U.S.:

- Top 10% = $248,610

- Top 5% = $390,209

- Top 1% = $1,199,812

The financial guidance available to active duty military personnel is predominantly designed for those in the earlier stages of their careers, focusing on the needs of younger service members and their families. This advice is crucial during those formative years, but as you progress, your financial requirements evolve. By finding US VetWealth, you've identified yourself as part of an exclusive group - the top 10% of military personnel who have achieved a level of success beyond the ordinary. Our firm exists because we recognized a critical gap in services for military retirees, particularly those in higher ranks or with longer service. Often, the assumption is that these individuals are well-off and have fewer concerns. However, the reality is that they face just as many, if not more, critical financial decisions. US VetWealth is dedicated to providing specialized, privatized wealth management solutions that are perfectly suited to your unique situation, helping you navigate this pivotal stage with confidence and ease.

At US VetWealth, we distinguish ourselves by not just being financial advisors but acting as specialized consultants dedicated to serving you, the military retiree. Our approach is unique because we offer access to an exclusive blend of industry knowledge and licensed professional expertise, tailored specifically to the needs of the military retiree community. Unlike traditional financial planners or money managers who aim to be a jack-of-all-trades, we focus solely on you. We're not in the race to accumulate clients; our goal is to connect with the right clients. We understand the importance of a perfect fit, and if we're not the best match for your needs, we'll be upfront about it, ensuring you don't waste a moment of your valuable time.

Decoding Military Retirement with a Veteran's Perspective

Your Tailored Pathway to Informed Retirement Choices

Join us for a thought-provoking session with CAPT (R) Mike Wallace, where we delve into the nuances of financial planning for military retirement. Our conversation sheds light on the pitfalls of a do-it-yourself approach and showcases our tailored decision-making process.

The episode highlights our distinctive approach, including a walkthrough of our Military Pay & Benefits calculator, setting a new standard in personalized military retirement planning.

This video is your gateway to understanding the true worth of your pension, empowering you to discuss these life-altering decisions with your spouse confidently.

Watch now and take the next step: schedule your personalized appraisal with us.

Decoding Military Retirement with a Veteran's Perspective

Your Tailored Pathway to Informed Retirement Choices

Join us for a thought-provoking session with CAPT (R) Mike Wallace, where we delve into the nuances of financial planning for military retirement. Our conversation sheds light on the pitfalls of a do-it-yourself approach and showcases our tailored decision-making process.

The episode highlights our distinctive approach, including a walkthrough of our Military Pay & Benefits calculator, setting a new standard in personalized military retirement planning.

This video is your gateway to understanding the true worth of your pension, empowering you to discuss these life-altering decisions with your spouse confidently.

Watch now and take the next step: schedule your personalized appraisal with us.

Connect and Follow Us vetwealth Online