10 Advantages Of The Military Pension Protection System | DFAS SBP Replacement

Conventional financial planning is something of a many-headed monster. Most financial planning vehicles only to do one thing, and some of them don’t even do it very well. There are various kinds of retirement plans, life/health/long-term care insurance, and college savings plans. The military also has its own financial planning tools: the Survivor Benefit Plan (SBP), Service Members Group Life Insurance (SGLI), and Veterans Group Life Insurance (VGLI). Understanding the ins and outs of all of these plans and policies, what they will and won’t do for you, what you can and can’t use them for and when, and how much they will cost in premiums and fees can get pretty complicated.

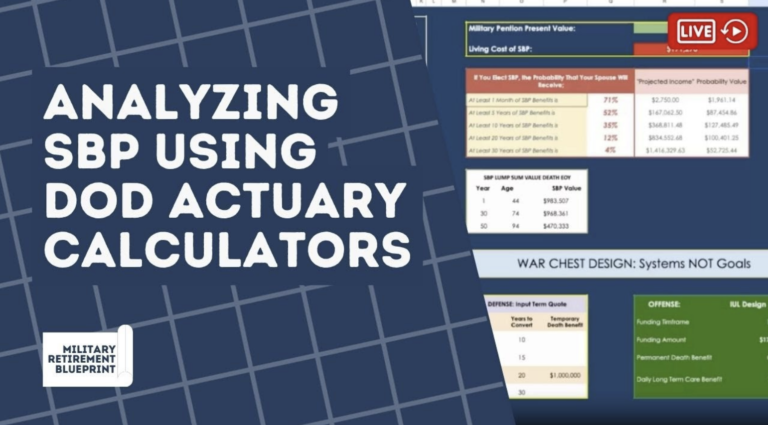

Here at US VetWealth, we focus primarily on customizing one military financial planning vehicle: a privatized Military Pension Protection System. Although this new, modern approach to privatizing the traditional military offerings of SBP, SGLI, and VGLI has been available for a few years, not many financial experts and professionals are aware of it or the game-changing advantages it offers:

We are transparent because we want to find the people that we know we are meant to be working with.

At the same time, we don’t want to waste the time of the people for whom our way of doing things isn’t the right fit. That’s why we have written extensively about the Military Pension Protection System on this site, so that you have the opportunity to learn as much as possible about it. We even get down in the weeds with some numbers with regards to the problems with status quo financial planning for military and veterans that our system is structured to solve.

In this post, however, I am going to stay really high-level and just run down the advantages of the Military Pension Protection System, because not only can it do a lot of really neat things that it might otherwise take multiple different plans to accomplish, it also takes the best features of all of those other financial vehicles and combines them together into one place, along with some stop-gap measures to prevent the worst features of those other financial vehicles from having an adverse effect on your financial planning.

The Top 10 Advantages of the Military Pension Protection System.

So here goes, in no particular order:

1. You don’t have to be in perfect health to qualify.

Many of the veterans that I talk to worry that they won’t qualify for the Military Pension Protection System. Typical concerns include their disability rating, tobacco use, flight status, being Special Forces, having a pre-existing health condition, and cannabis use. None of these things are show-stoppers. Many retiring service members receive disability ratings from the VA for issues that are relatively minor and of no concern at all to life insurance underwriters.

There are many disabilities that are quite serious with regards to their effect on your daily life that don’t necessarily impact your potential lifespan, so it is worth the time to go through the underwriting process to see whether or not your disability will prevent you from qualifying. Disability ratings aside, it is possible to obtain a policy within a variety of situations. When qualifying during the underwriting process, the insurance company is making a determination of how much of a death benefit they should offer you based on the likelihood that they are going to have to pay out this death benefit.

Any impact that your physical condition or lifestyle may have on the amount of death benefit you qualify for should not prevent you from pursuing this option if you determine that it is the best option for your individual situation, because unlike SGLI/VGLI or term or whole life insurance, our system isn’t all about the death benefit. Sure there is a death benefit, but the plan is about having a place to protect and grow your money, without risk of loss due to market volatility or taxes.

That said, health qualification is an aspect of establishing a private pension insurance account. If you think these might be viable retired military financial services for you, the sooner you initiate the process, while younger and in good health, the easier the process will be.

2. You don’t have to have a lot of money to fund the plan.

To put it bluntly, you can probably fund the Military Pension Protection System with less than you would need to fund some of the more traditional options available to you. Once you are qualified, you can fund it however you want to. You can pay for it for as long or as short of a period as you like. You can customize your premiums/contributions and make adjustments to them over time as your life circumstances change.

3. Get a guaranteed return on your investment.

You are able to both capture and lock in the growth offered by the securities market without the value of your policy being negatively affected by market corrections. The worst case scenario market rate of return in any circumstances is zero, meaning you get to keep all of your market gains, but you don’t experience market losses; if the market tanks, you simply experience zero growth on your intact principal. Even better, the benefit doesn’t just get paid to the spouse, like with the SBP; nor does the benefit evaporate should the spouse predeceases the retiree. Your system can be structured so that it can outlive both you and your spouse, and get paid to the next generation as a legacy.

4. Avoid opportunity cost.

There is an opportunity cost for paying 6.5% of your pension into the SBP. The SBP will pay a monthly annuity for the remaining lifetime of the surviving spouse, but only if the retiree dies. And in many cases, the annuity is considerably less than what 6.5% of a military pension might have generated if it had been invested over the long term. Modern life Insurance for military is a new asset class available to anyone.

When we first set up your Military Pension Protection System, we structure it so as to provide the lowest possible death benefit at inception. We do this because the smaller the death benefit initially, the lower the cost to fund the plan. In this way, we can take the type of product that would normally take 10 to 15 years just to break even and bring that timeline down to three to five years, if not immediately.

It takes a lot less time for the cash value of the policy to grow at a pace that outstrips inflation and quickly starts keeping pace with things like the S&P 500. The money you are using to fund the plan not only keeps pace with inflation, but grows in value over time, because it is invested.

5. You don’t have to start a plan from scratch.

If you already have one of the older whole life insurance plans, you can redirect that investment into the Military Pension Protection System, along with whatever other contributions you want to provide, using a mechanism called a 1035 exchange.

The best return an older whole life plan will be able to give you is between two and four percent compounded annually, and the death benefits are typically significantly higher than they need to be because they are sold as an alternative to term instead of as a compliment. What this all adds up to is that these plans are expensive, and it typically takes 10 to 15 years of regular contributions for an insured person to have the plan paid off so that they can access their equity.

Moving these funds into a private pension account using the 1035 provision allows not only a higher growth rate, but the ability to both build and access equity much sooner. This basically amounts to taking money that you've already put to work for you and giving it a raise.

6. Your money is liquid.

You can’t take your money out of the SBP, term life insurance policies, or even whole life (until a certain point, and then it will cost you money). But with the Military Pension Protection System, there is something called the cash surrender value, which is the amount of fully liquid cash that's available to be taken in distributions without penalties or taxes.

As long as a person keeps 10% of that number inside the plan, they can do whatever they want with the other 90%, which is made up of a combination of contributions and the returns on invested dollars.

7. Enjoy a tax-free retirement.

Those looking to retire in the next decade or so face a lot of uncertainty when it comes to taxes. Because of the demographic changes occurring today (more baby boomers retiring, less millennials working) and the rising national debt, the current low rates of taxes simply cannot be maintained and still pay for unfunded government liabilities such as social security, Medicare, and Medicaid.

The distributions from the 401(k) retirement plans that so many people rely on are subject to income tax as soon as you begin taking your Required Minimum Distributions at age 70 ½ . Most people assume that by the time they start taking those distributions, their tax bracket is going to be lower; but there is every possibility that we can expect much higher marginal tax rates within the next decade.

This means that your retirement savings may be worth significantly less than you think they are. Military Pension Protection System, however, leverages IRS code 72(t) to combine tax advantages with greater flexibility and control, allowing you to access up to 90% of the equity of your private pension account tax free.

8. Pay for long term care for yourself or a loved one.

No one wants to think that there might come a day when they can’t take care of themselves, but it happens. People are living longer and needing more help than they did even decades ago, and the VA and Medicare aren’t going to cover all of these costs. What if you or a loved one need assisted living or a nursing home?

There’s no way to leverage anything you have invested into the SBP or VGLI to help cover long term care costs. Your Military Pension Protection System, however, offers a long term care provision with which a living insured would be able to use a portion of their death benefit to pay for assisted living costs, even if those costs are paid to a close friend or family member.

With a private pension account, you can ensure your own self-care and still have a large probability of leaving a lasting legacy for your heirs.

9. Protect your assets from litigation.

A permanent life insurance policy is not considered part of an estate tax bill or otherwise considered to be part of an individual’s net worth in terms of what lawyers are able to retain or what can be tapped to pay for legal damages.

In the event that you are involved in a lawsuit that ends badly, whatever other assets might be taken from you, you will retain complete control over and access to your private pension insurance account.

10. Skip the 9-to-5 grind and find a new way to serve in your post-military life.

For some people the standard aspects of financial planning military retirement life insurance college etc. are not enough. Their financial planning needs to include different ways of saving money that allow them to actually ACCESS that money in the PRESENT if they want to try out an idea or make some change in how they are living.

So many of this kind of individual are just keeping their money in a checking account, which isn’t efficient. In addition to all of the advantages described above, the Military Pension Protection System allows you to access up to 90% of your equity in the plan at any time and for anything.

While we sometimes focus on the advantages with regards to retirement and survivor benefit plan costs, the advantages of flexibility and control are limitless with this plan. If you know that you are going to want to start a business, or a non-profit, or just travel the world when you transition out of the military, the sooner you open an account, the more able you will be to pursue your passions and begin serving in a whole new way in your post-military life.

The Military Pension Protection System is not for everyone.

Depending on your individual, family, health, and financial situations, as well as your vision for your life, some combination of the traditional military and civilian financial planning strategies may be the best solution for you.

But what we have found is that for individuals who do not want to follow the conventional path from military service to 9-to-5 job to retirement that the private pension strategy offers both sensible financial protection for the family (tax-free retirement income, long term care protection, legacy for heirs, etc.) and the flexibility, control, and liquidity that will allow these individuals to forge their own path.

If this sounds like you, then reach out to US VetWealth today to discuss your options.