Is VGLI Life Insurance Enough to Protect Your Military Pension? [E7 Case Study]

When you retire from military service, there are a few important financial steps you need to take in order to protect your pension. One of those is getting life insurance coverage through the Veterans Group Life Insurance (VGLI) program, and another is signing up for Survivor Benefit Plan (SBP) coverage. But are VGLI life insurance benefits and SBP enough to protect your military pension? Let's take a closer look.

What’s the True Value of Your Service?

For context this scenario applies to roughly 80% of retiring career military families who never opt out of the SBP, adjusted for time in service and rank. We have other articles and videos on this site looking more specifically at SBP alternative case studies available to veterans.

Scenario: A 40-year-old retiring male E7 with 20 years of service has an active duty RMC of $104,000 a year. He will receive an annual pension of roughly $30,000. If his spouse elects the SBP, if he predeceases her, she would receive 55% of the pension, $16,500 a year or about $1,375 per month until she, also, passes.

So what is the true value of the E7’s retirement pay, and will the veteran and the spouse receive that true value in this scenario?

Calculate the Military Pension Present Value

To answer that question, we need to do a little math.

Let’s assume that the E7 lives for 30 years beyond his military retirement, to the age of 70. That $30,000-a-year pension paid out annually over 30 years, including adjustments (2.5%) for inflation over the next 30 years, amounts to a total of $967,000. This is the amount of money that the E7 would need to have RIGHT NOW, invested in an account that’s earning at least 4% interest, in order to generate a $30,000 a year annuity.

How the SBP Works to protect the pension

The present value of just the E7 retirement pay is just shy of $1 Million. What this really means is that you now own a million dollar asset that goes away when the Veteran passes away. In the event that the E7 dies, his spouse will only receive 55% of that pension, or ONLY $16,500 a year. And to make it worse, the SBP is taxable income!

Is there a scenario in which the surviving spouse could realize the full value of the E7’s pension through SBP payouts? Sure. The spouse would have to receive an SBP payment of $1,375/month for over 58 years in order to realize $967,000, a situation which is highly unlikely.

Like with SGLI there is a cost for this benefit of 6.5% of the pension for the first 30 years which would total around $80,000 in payments for this E7.

Let’s Bring VGLI Into This picture

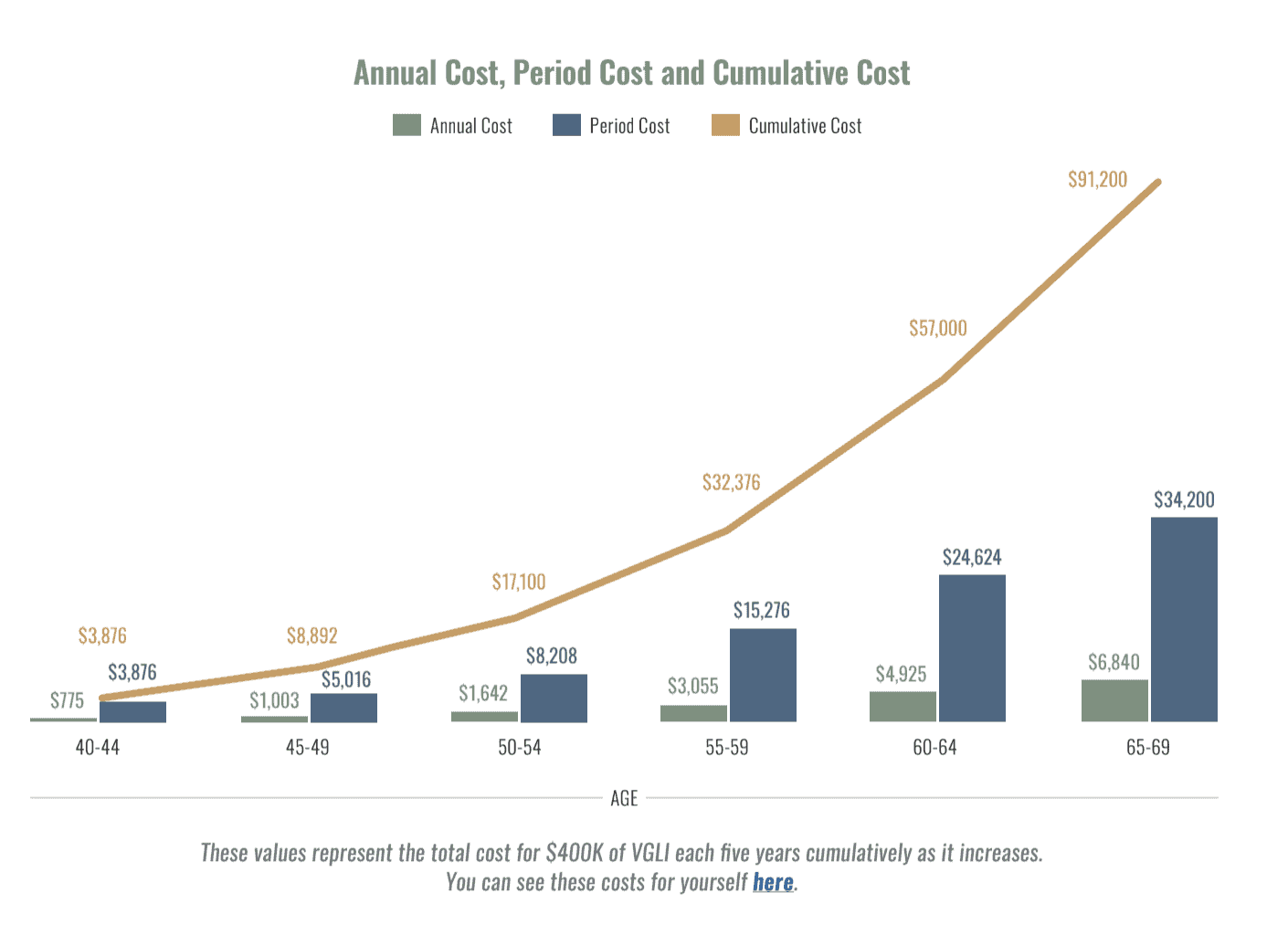

The E7 is used to paying $300 a year for SGLI. However, VGLI, which replaces SGLI upon retirement, is significantly more expensive than SGLI, because the amount of government subsidy significantly decreases.

Just how costly is VGLI?

In year one, VGLI is $800 a year (vs. $300 a year being paid previously). And every five years, the premium will go up. Over a 30-year period, during which the E7 is statistically unlikely to die, he will have paid over $90,000 into VGLI.

The cost of veterans group Life InsuranceVGLI over 70 becomes astronomical. Say our E7 wants to leaves the (mere) $400,000 death benefit for his spouse. By the time he reaches the age of 75, he'll be paying $1,840 a month for this coverage.

These standard premium rates are astronomical. It's unrealistic to expect that any veteran living off their pension will be able to keep up with them. What if they have to stop coverage because they can no longer afford the VGLI premiums? Then that $400,000 death benefit is not going to be around when the veteran wants to leave a legacy.

How do VGLI insurance death benefits work?

If the spouse predeceases the veteran, the family will see no return on this investment unless the veteran maintains VGLI coverage for an adult child. If the veteran predeceases the spouse, and both SBP and the VGLI life insurance policy are paid out, the spouse will receive a maximum of $400,000 in a death benefit (if they elected the maximum coverage) and only $16,500 annually going forward.

The surviving spouse is being set up to struggle over the long term, with no realistic opportunity for the E7 and his spouse to leave a legacy for the next generation.

For the sake of the scenario, let’s assume that the E7 dies around 30 years after retirement at the age of 70 with the VGLI still in force, and the spouse, who is the same age, lives for another 18 years.

The best case scenario here, with regards to return on investment (ROI), is that a) the E7 dies, and b) the surviving spouse receives $400,000 from the VGLI death benefit, and $297,000 in TAXABLE SBP payouts ($1,375 a month for 18 years), for a gross benefit of $697,000.

This is hundreds of thousands of dollars less than the true value of the E7’s retirement pay ($967,000). But wait, let’s not forget to subtract the $170,000 the E7 and his spouse paid for this coverage in SBP and VGLI premiums, bringing their net ROI down to $517,000, approximately half of what the E7’s pension was worth adjusted for inflation over 30 years, AND there is no legacy for any children when the E7’s spouse passes away.

Group Life Insurance VGLI: Fixed Premiums & Limited Benefits

Veterans Group Life Insurance coverage, which is administered by the Veterans Affairs, is offered to veterans as a replacement for servicemembers group life insurance SGLI. You don't need to apply for VGLI if coverage is accepted within 240 days of service, which makes it a good option for the service member with a life-threatening disability who is thus unable to qualify for privatized life insurance.

But for most retiring service members, VGLI has some definite disadvantages.

- The VGLI life insurance death benefit is capped at $400,000.

- Veterans who are still young and in good health can likely qualify for a higher life insurance death benefit at a lower insurance premium rate on the private market.

- Like SGLI coverage, VGLI life insurance is the same fixed cost for everybody. However, the base cost of VGLI (which starts at $800/year) is much more expensive than SGLI (which is a flat $300/year for the active duty period).

- The group life insurance VGLI premium increases every five years.

Better options to Protect the Full value of your retirement pay.

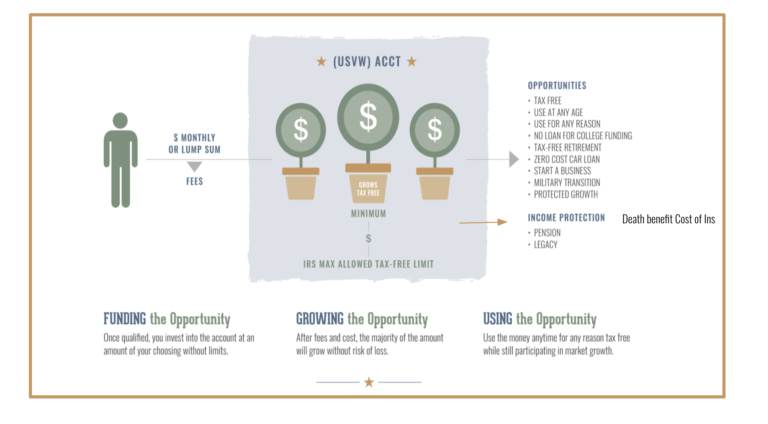

Here at US VetWealth, we have designed an alternative to the status quo military financial planning life insurance policy options. Our solution is a great alternative to a VGLI policy as we leverage both modern term policies and permanent cash value life insurance plans.

Depending on your life insurance needs we do what the Department of Veterans Affairs can’t possibly do, design an individual life insurance policy that allows you to leave a legacy behind you when you die but access to a cash asset to give you a living return on investment.

We call it the Military Pension Protection System

This completely new approach to privatizing the SBP or pension protection has become available in recent years; however, few financial experts and professionals are aware of this solution and the game-changing benefits it brings to solving the SBP problem.

We ditch the outdated term life and whole life policies that have become more expensive, less flexible, and aren't much different that VGLI coverage anyways.

Modern life insurance can provide the death benefit protection of a term life policy like the VGLI coverage amount while also producing an annuity stream much like the SBP; to be more accurate, it can provide an annuity stream much like the pension, because the payouts are higher, and you can use it while the veteran is still alive!

Further, after 30 years, the premiums are significantly lower than SBP and a VGLI policy, and the ROI is significantly higher than on VGLI, a term life insurance or whole life policy. It also costs less than the fees involved in typical Thrift Savings Plan (TSP), 401k, mutual funds, or other retirement plans that come along with money managers all taking a cut of the investment, regardless of the plan’s performance.

Although VGLI and SBP are important, they may not be enough to protect your military pension. That's why it's important to consult with a life insurance agent who specializes in helping veterans like you get the coverage you need. At US VetWealth, we understand the unique needs of our service members and their families, and we're here to help you find the best life insurance policy for your needs. Schedule a free consultation today and let us help you protect your hard-earned retirement savings.

![Is VGLI Life Insurance Enough to Protect Your Military Pension? [E7 Case Study] 1 Is VGLI Life Insurance Enough to Protect Your Military Pension? [E7 Case Study]](https://usvetwealth.com/wp-content/uploads/2022/01/Pros-cons-3.jpg)