How To Use The Regular Military Pay Calculator 2022

Learn how to quickly use the 2022 Military Pay Calculator to estimate your annual compensation, basic allowance and benefits based on your pay grade and duty station zip code.

Why is this important?

Military service members, you need to know how much military pay you're getting every month and what it's worth. Leave and Earnings Statements (LES) can be hard for anyone to understand, but luckily there are calculators that do the math for you!

This post will give instructions on how to use our Military Paycheck Calculator in 2022 to help estimate your annual military compensation and benefits. It is important not only because of the LES, but also because knowing your military pay makes it easier when considering a job change or retirement. Service members should know their worth so they can make informed decisions about their careers.

Glossary of Military Pay Calculator Terms

- Basic allowance for housing: Those who are denied government housing and live on the local private housing market in the US receive BAH rates depending on the place they live and pay level of the service and whether the service member is dependent and family size.

- Basic Allowance for Subsistence (BAS): Service members receive BAS in exchange for the payment of meals by their members. In addition, a military member pays for food from government and is paid a full BAS. '.

- Basic pay: Basic paid is part of regular pay and consists of years of service and rank. This is the taxable portion.

- Special Pay: Services members who receive special pay are given compensation for their efforts to perform military duties in areas such as flight, submarine work, nuclear technicians and any other military duty where special training is required.

- Hazard Pay: Service members receive hazard pay if they work in hazardous conditions or zone. This includes hazardous duty locations that require extra performance because of special training or emergency duties.

Use The DFAS Military Pay Calculator in 2022

Many veterans looking for civilian employment or work with a government agency have a difficult time knowing a target salary. They don't know how to value themselves or their service in that way. They have a vague understanding of the true annual pay they receive. But they don't know exactly how to calculate military basic allowance and housing allowance.

Instead, they get fixated on the pay chart that the DOD releases every year that doesn't include the non taxable portion. The problem is that the pay chart only shows the monthly base pay amount. It's too easy for one to see that number, like what they see, know exactly what rank or years of service they need to increase their pay, and stop their analysis there.

This is a huge mistake!

However, if you follow the example in the above video. You'll quickly see the value of calculating your total Regular Military Compensation.

How much tax is taken out of my paycheck?

This calculator estimates regular military pay based on a regular calendar year. The taxes deducted from your paycheck are determined by the location at which you's service and how much time you have spent in the tax bracket. Different states have different income taxes, so it depends where you live or plan to live after your service is over. For regular military pay, the calculator will make deductions at 4%, 7%, 10% or 15% tax rates.

Is my special pay tax free?

The regular Military Calculator does not take into account special and incentive pays like housing allowance because regular military pay is "regular" – meaning it's the bulk of your income. You can think of regular military pay as your regular savings account, and special pay is like a bonus.

If I get an increase in regular military pay, will the benefits I get remain the same?

No. An increase of regular military pay affects your Basic Pay, BAS, BAH and tax rate, but increases to family/dependent pay or special pays stay at their current levels.

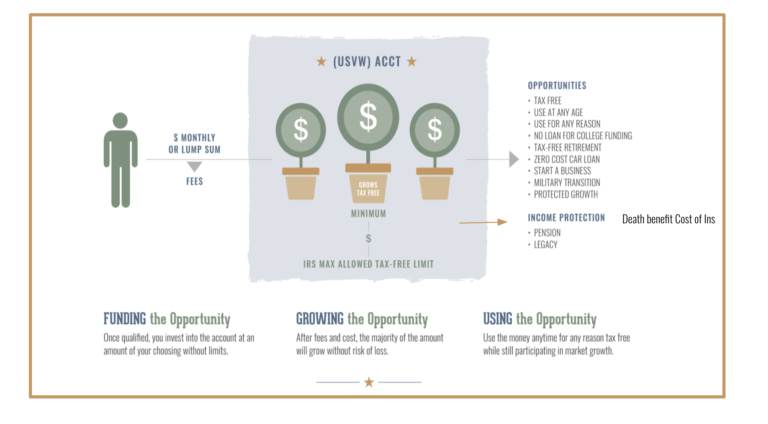

Am I required to deduct the Service Members Group Life Insurance (SGLI) from my monthly basic pay?

The assumed approach to protect your regular military compensation is by paying for the $400K SGLI death benefit to cover your dependents should something happen. But no one asks why your enlisted members pay the same $25/month as senior officers pay. Every other aspect of pay is based on rank, except for this? WHY?

How this Impacts Career Military Families

If you are planning on serving 20 years or more to collect a retirement pension this is even more important. Why? Because of the potentially high costs of the Survivor Benefit Plan. Who is eligible for military retirement pay?

Families need to know the true costs of serving for 20 years. Serving the country is often perceived as a way to serve your country and receive free benefits when you retire.

Work with a US VetWealth Financial Professional

If you are eligible, we encourage service members to take advantage of the unique financial benefits they have as a military retiree. We can help armed forces personnel maximize their LES and TSP funds by helping them create a long-term plan for retirement or exploring other investment options.

We can also help veterans and armed forces personnel make critical decisions regarding any type of financial matter, such as investments or insurance products. Schedule a free discovery call today.

![[College Savings] A Better Plan Than Hoping for Military Child Scholarships 5 [College Savings] A Better Plan Than Hoping for Military Child Scholarships](https://usvetwealth.com/wp-content/uploads/2019/08/Screen-Shot-2019-08-22-at-6.42.28-PM-e1590788855769-768x492.png)