Private Pension / SBP Alternative: A Guide to Qualifying for the US VetWealth Approach

The Importance of Having a Retirement Plan

Retirement is one of the most important life events for everyone, especially for those who have served in the military. It is a time when you can relax, enjoy life, and spend time with your loved ones. However, it is also a time when you need to make important financial decisions. The biggest decision is how you will receive a steady income stream to cover your living expenses.

Understanding Military Retirement Benefits

If you are a retired military member, you are eligible to receive a military pension. This pension is your most valuable asset and is the foundation of your retirement income. The military pension is paid to you for life and is adjusted annually based on the cost of living. However, it is not enough to cover all of your living expenses, and you need to find other sources of income.

The Survivor Benefit Plan (SBP)

One of the options available to military retirees is the Survivor Benefit Plan (SBP). The SBP is a voluntary program that provides a portion of your pension to your surviving spouse in the event of your death. This can be a valuable option for many retirees, but it does come with some limitations. The SBP is not adjustable for inflation, and the amount of coverage is limited.

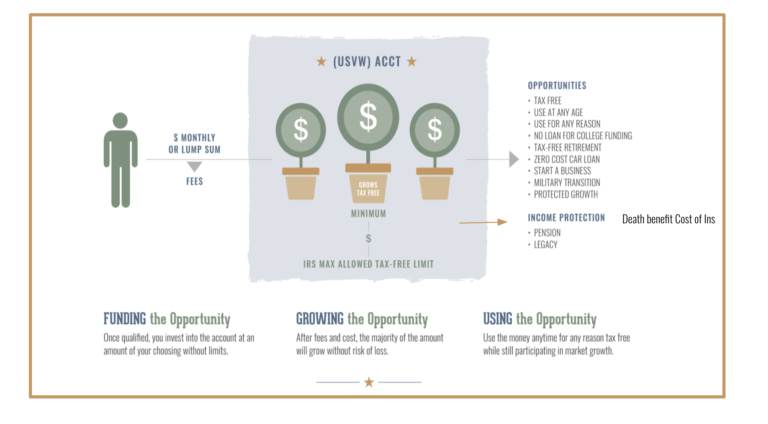

The Private Pension / SBP Alternative: US VetWealth

If you are looking for a better alternative to the Survivor Benefit Plan (SBP), the US VetWealth private pension approach may be a good fit for you. This approach is designed to enhance your military pension and provide you with additional retirement income. The US VetWealth approach is a private pension program that provides a steady income stream for life, adjustable for inflation, and is not limited by the amount of coverage.

The Qualification Process

To qualify for the US VetWealth approach, you need to meet certain financial and health criteria. The financial criteria include your income level, your investment portfolio, and your overall financial situation. The health criteria include your current health status, your age, and any pre-existing medical conditions.

The Benefits of Qualifying for US VetWealth

If you qualify for the US VetWealth approach, you can enjoy a number of benefits, including:

- A steady income stream for life, adjustable for inflation

- A higher level of retirement income than the SBP

- More flexibility in your retirement planning

- The ability to reposition your assets, time, and talent

How to Get Started

If you are interested in qualifying for the US VetWealth approach, the first step is to sign up for our private portal members area. Inside the portal, you will have access to our resources, including videos, guides, and case studies. You can also interact with us live to answer any questions you may have.

The Importance of Working with a Professional

While you can get everything you need to decide whether the US VetWealth approach is a good fit for you from our resources, it is still important to work with a professional. A professional can help you with the analysis and design of your private pension strategy, and ensure that you are maximizing your resources and making the best decisions for your retirement.

Retirement is a time when you need to make important financial decisions, and it is important to have a solid plan in place. The US VetWealth private pension approach is a great alternative to the Survivor Benefit Plan (SBP), and can provide you with a steady income stream for life, adjustable for inflation, and a higher level of retirement income. If you are interested in qualifying for the US VetWealth approach, the first step is to sign up for our private portal members area. Inside the portal, you will have access to our resources, including videos, guides, and case studies. Additionally, working with a professional can help ensure that you are maximizing your resources and making the best decisions for your retirement. Whether you are just starting to think about retirement or are already in retirement, the US VetWealth private pension approach is worth considering as a means to enhance your military pension and ensure a secure financial future. Schedule a Call today.

Unlock the full potential of your retirement with our Military Retirement Blueprint video series. With 25 micro-lessons, you'll have access to the expert knowledge and strategies you need to maximize your financial, health, and lifestyle opportunities. Furthermore, you will have exclusive access to our specialized knowledge library designed specifically for military retirees who are or will become high-income earners. It's a new and better alternative to "Benefits & Transition Assistance." Don't miss out on this valuable opportunity - start your FREE trial now and gain access to our insiders portal. Invest in your future and take control of your retirement today! Visit https://militaryretirementblueprint.com/